Simplify Your Mortgage Experience with Smarter

Financing Solutions

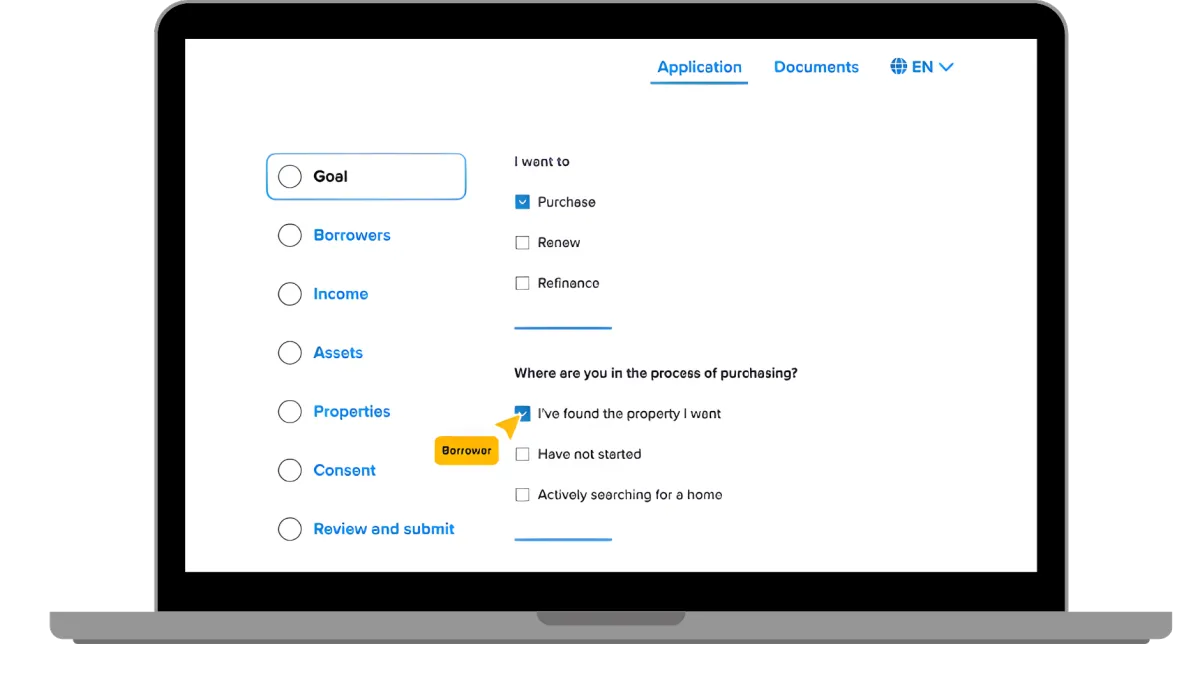

We help home buyers, homeowners, and investors secure the right mortgage with expert advice, competitive rates, and a seamless digital process.

No obligation

Secure application

Smart Mortgages Made Simple

Pre-Approval

Income, credit, and goals are reviewed to determine buying power. This creates clarity and confidence before shopping and strengthens offers.

Purchase

Mortgage options are reviewed and lenders are compared to select the right terms. This keeps financing aligned with your purchase and plans.

Renew or Refinance

Renewal and refinancing options are reviewed as terms end or needs change. This helps improve rates, adjust payments, or access equity wisely.

Mortgage Solutions Where Strategy Meets Simplicity

MORTGAGE EXPERT

Austin Simon

Mortgage brokers simplify home financing by comparing options across many lenders. Clients receive advice based on their full financial picture and long-term goals.

From purchases to renewals, the focus remains on clear guidance, better options, and ongoing support.

Access to more lenders

Personalized advice

Support beyond closing.

Always Within Reach to Support Your Mortgage Goals

Communication

Clear updates and explanations are provided throughout the process. Questions are answered quickly to support confident decisions.

Application Tracking

Progress is tracked from submission to approval with proactive follow-ups. This keeps the process moving smoothly and on schedule.

Ongoing Advice

Guidance continues beyond closing with renewals and refinancing reviews. This keeps the mortgage aligned as needs change over time.

Frequently Asked Questions

Do mortgage brokers actually get better rates?

Often, yes. Brokers have access to rates from multiple lenders, including some not available directly to consumers, and can compare them to find competitive options for your situation.

Will talking to a mortgage broker hurt my credit score?

No. Speaking with a mortgage broker and reviewing options does not impact your credit. A credit check is only completed if you choose to proceed with a pre-approval or application.

Is it better to go to a bank or use a mortgage broker?

A bank can only offer its own products, while a broker compares multiple lenders. Many borrowers choose brokers for broader choice, unbiased advice, and help navigating lender differences.

What matters more, the interest rate or the mortgage terms?

Both are important, but terms often matter more long term. A broker helps evaluate penalties, flexibility, and features alongside the rate to reduce future costs and risks.

Can a mortgage broker help if I’m self-employed?

Yes. Brokers regularly work with lenders that specialize in self-employed and non-traditional income, helping structure applications that reflect true earning ability.

Should I choose a fixed or variable mortgage rate?

It depends on comfort level, cash flow, and long-term plans. A broker explains the pros and cons of each option so the decision is based on strategy, not guesswork.

Can I break my mortgage early if I need to?

Yes, but penalties can vary significantly between lenders. A broker helps explain these differences upfront so you avoid unnecessary costs later.

When is the best time to talk to a mortgage broker?

As early as possible. Speaking with a broker before buying, refinancing, or renewing helps set expectations, uncover options, and avoid surprises.

Contact Us

Have questions about mortgage options, rates, or next steps? Reach out to start a conversation and get clear guidance tailored to your situation.

(289) 395-2785

5063 N Service Rd Suite 100-427, Burlington Ontario L7L 5H6